Let us help you navigate all your options to insure your family's future.

LIFE INSURANCE

The two certainties of life ...death and taxes!

Life insurance provides a "tax-free" benefit payout to your family after your death.

This death benefit can be used to pay for final expenses, outstanding debts including your mortgage and may help your family manage the costs of daily living expenses, and education tuition after you are gone.

With the Canadian household debt-to-income ratio increasing almost all Canadian’s require some form of life insurance. Questions to consider are:

"If you died tomorrow, how would your loved ones fare financially?"

Would they have the money to pay for your final expenses (e.g., funeral costs, medical bills, taxes, debts, lawyers’ fees, etc.)?

Would they be able to meet ongoing living expenses like the rent or mortgage, food, clothing, transportation costs, healthcare, etc.?

What about long-range financial goals? Without your contribution to the household, would your surviving spouse be able to save enough money to put the kids through college or retire comfortably?

The truth is, it's always a struggle when you lose someone you love. But your emotional struggles shouldn’t be compounded by financial difficulties. Life insurance helps make sure that the people you care about will be provided for financially, even if you're not there to care for them yourself.

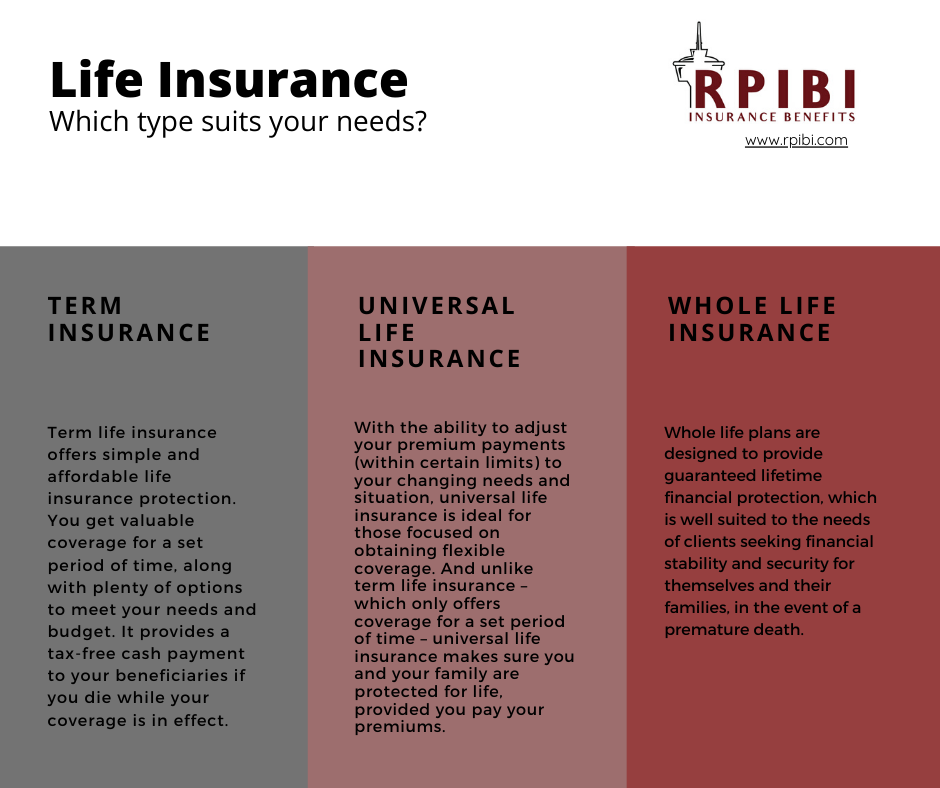

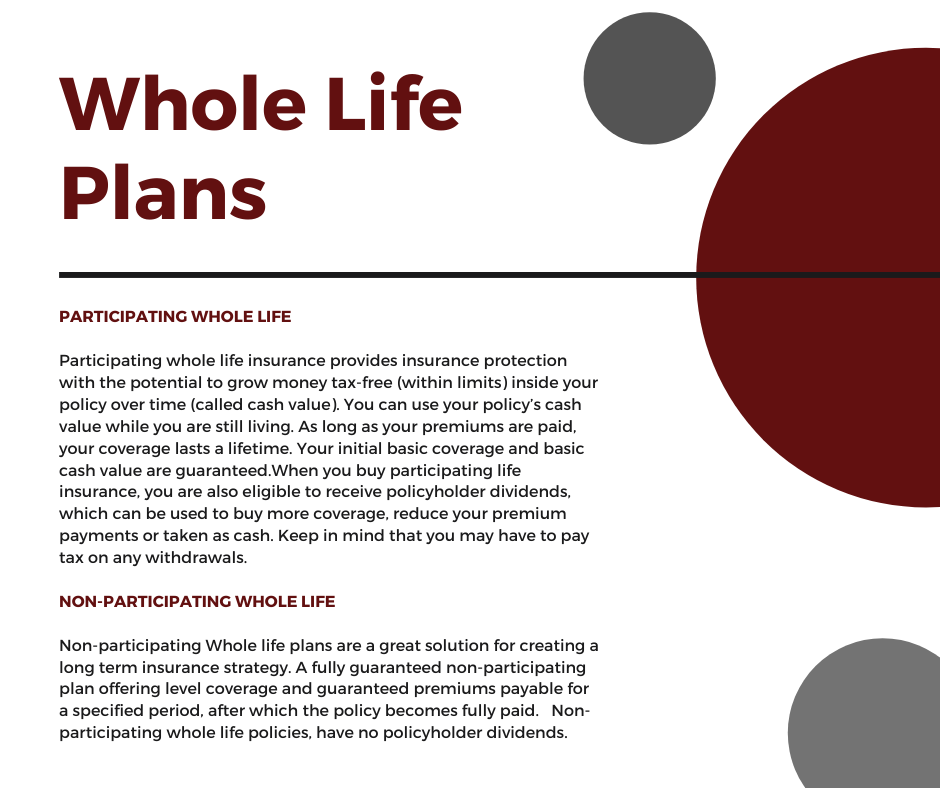

There are different types of life insurance such as Term, Universal and Whole Life; please contact us to discuss which of these best suit your needs.